As a Malaysian SME owner, managing operations, sales, and hiring is already a full-time job. Adding payroll into the mix—calculating deductions, complying with labor laws, and keeping up with submissions—can lead to errors that impact both employees and your bottom line.

That’s why more small businesses are turning to outsourced payroll services in Malaysia—not as a luxury, but as a practical solution for saving time, staying compliant, and scaling with confidence.

Why Manual Payroll Drains Your Resources

Each month, you’re expected to:

- Calculate base salaries, overtime, bonuses, and allowances

- Deduct PCB income tax according to the latest LHDN guidelines

- Submit contributions to EPF, SOCSO, and EIS

- Generate and distribute compliant payslips

- Track employee leave, claims, and entitlements

For a lean team, one error in these processes can mean delayed payments, tax penalties, or employee frustration—all of which eat into your valuable time.

3 Reasons SMEs Benefit from Outsourced Payroll

Outsourcing to a reliable provider helps your business in three major ways:

1. Cost Control

- Avoid the overhead of hiring full-time payroll personnel

- Eliminate the need for payroll software training or licensing fees

- Only pay for the services you actually use, with flexible pricing models

2. Time Recovery

- Reclaim 15 to even more than 20 hours monthly to focus on business development

- Skip the hassle of interpreting statutory updates or filing deadlines

3. Compliance Confidence

- Payroll is calculated using the latest statutory rates and rules

- Secure recordkeeping ensures you’re audit-ready at all times

- Sensitive data is handled on a secure, cloud-based platform in line with local standards

5 Must-Have Features in a Payroll Service for SMEs

When choosing a provider, look for these SME-focused features:

| Feature | Why It Matters |

| Local Payroll Expertise | They understand Malaysian labor laws, contributions, and salary practices |

| Flexible, Transparent Pricing | Ideal for small teams – no long-term contracts or hidden fees |

| Digital Self-Service Portal | Employees can access payslips and HR documents anytime, anywhere |

| Core HR Integration | Syncs payroll with leave, claims, and attendance—no duplicate entry needed |

| Direct Support Access | You’ll want a real person – not a call center, when issues arise |

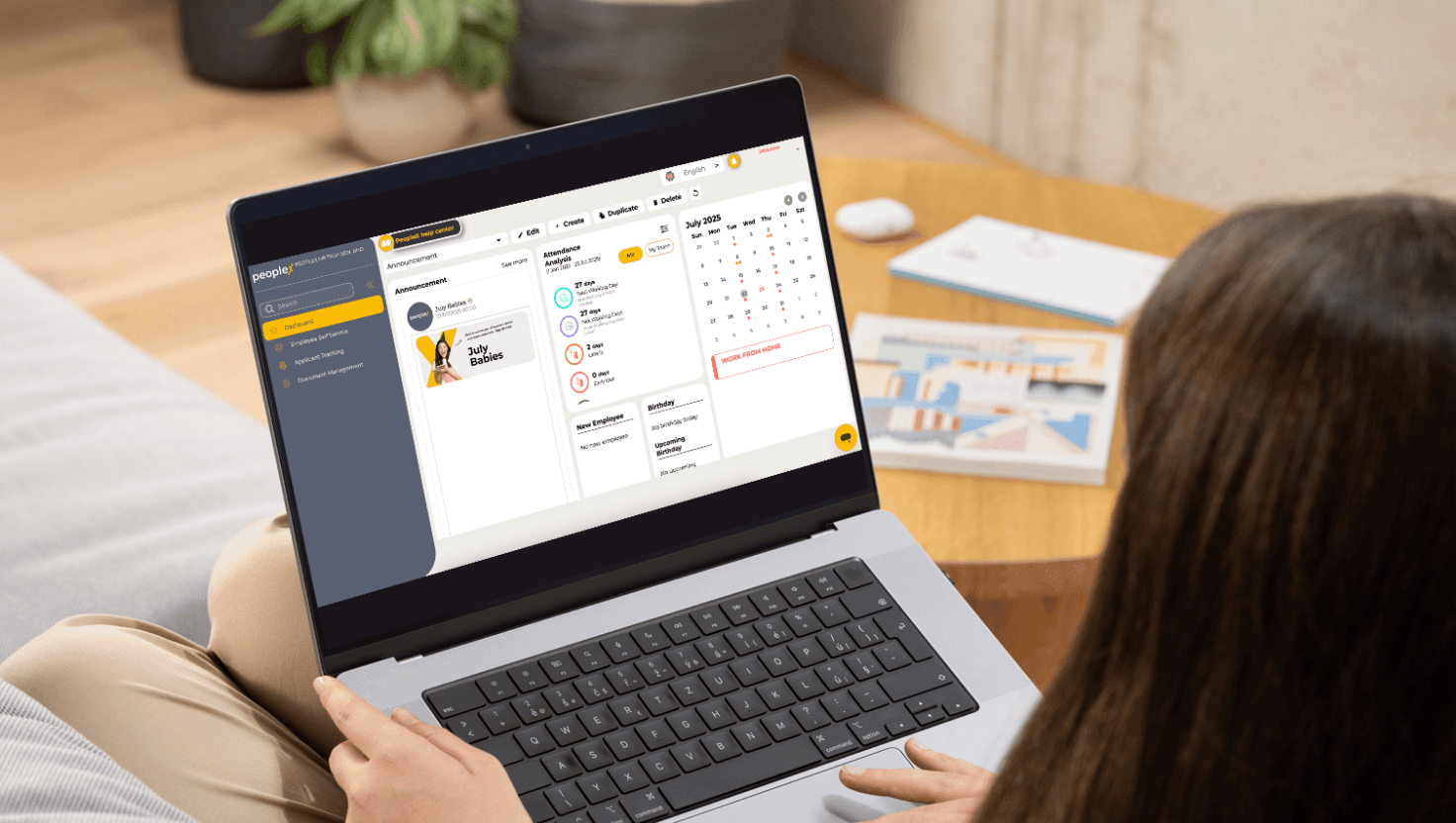

Why PeopleX Is Built for Malaysian Small Businesses

PeopleX is a payroll and HR platform built in Malaysia with small businesses in mind. Here’s how it supports SMEs:

- Quick Setup, No Tech Headaches

You can be onboarded in under 48 hours. No heavy IT requirements, no complex systems. - All-in-One HR Platform

View payslip, leave, attendance, and employee claims from a single dashboard—designed to reduce admin and improve efficiency. - Automated Compliance

Stay updated with EPF, SOCSO, EIS, and tax requirements—PeopleX’s system is always aligned with current legislation. - Scalable for Growth

Whether you have five employees or 500, the platform grows with you—no need to switch providers as you expand.

Conclusion

Outsourcing payroll doesn’t mean giving up control—it means gaining peace of mind.

With PeopleX’s payroll service in Malaysia, you get:

- A fully managed, digital-first payroll process

- Local compliance, built-in

- Clear pricing with no hidden surprises

- More time to grow your business and lead your team

Let payroll be one less thing on your to-do list—start smart with PeopleX.

Frequently Asked Questions (FAQs)

How does PeopleX simplify payroll outsourcing for Malaysian SMEs?

PeopleX handles salary calculations, EPF, SOCSO, EIS, and LHDN compliance while offering a digital HR platform that centralizes payslips, leave, claims, and attendance—making payroll and HR management simple for small businesses.

Can PeopleX’s payroll service grow with my business as we expand?

Yes. PeopleX is designed for scalability—whether you have 5 employees or 500, the payroll and HR platform adjusts seamlessly without needing to change providers.

What makes PeopleX different from other payroll outsourcing providers in Malaysia?

Unlike traditional providers, PeopleX combines expert-managed payroll outsourcing with a modern HR system. This means your payroll is fully compliant while employees enjoy digital self-service access to payslips, leave, and claims—all in one platform.

How quickly can my SME get started with PeopleX payroll outsourcing?

Onboarding is fast and hassle-free—most small businesses can be set up in under 48 hours, without heavy IT requirements.

Does PeopleX’s payroll outsourcing ensure compliance with Malaysian regulations?

Yes. PeopleX’s system is updated in real-time with the latest EPF, SOCSO, EIS, and tax rules, so payroll is always processed in line with Malaysian statutory requirements.