If you are earning income in Malaysia, you are required to file your taxes with Lembaga Hasil Dalam Negeri (LHDN). The first step is to create an individual account on MyTax, also known as e-Daftar. This online portal allows you to manage your tax matters conveniently without visiting the tax office.

In this guide, we’ll walk you through the complete step-by-step process for registering your MyTax (e-Daftar) account and completing your first-time login.

Step 1: Access the e-Daftar Page

Navigate directly to the e-Daftar registration page:

👉 https://mytax.hasil.gov.my/ezHasil?data=e-Daftar

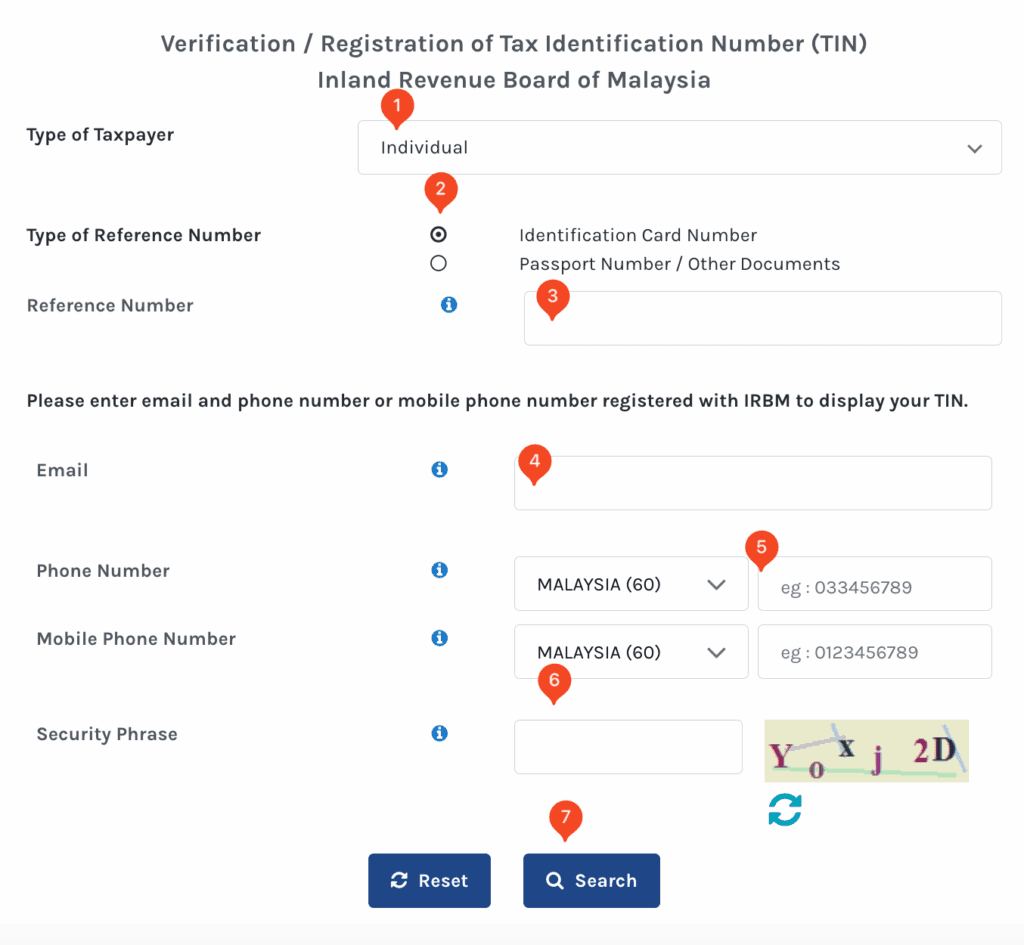

Step 2: Fill in the Verification / Registration of Tax Identification Number (TIN) Section

On this page, you will see the Verification / Registration of Tax Identification Number (TIN) form. Fill it in as follows:

- Type of Taxpayer – Select Individual.

- Type of Reference Number –

- Select Identification Card Number (for Malaysian citizens), or

- Select Passport Number (for foreigners).

- Reference Number – Enter your IC Number or Passport Number.

- 📌 Remark: Foreigners also need to fill in Passport Country.

- Email Address – Provide a valid email address.

- Phone Number & Mobile Phone Number – Enter your contact details.

- Security Phrase – Enter the characters shown in the image provided.

- Click on the Search button.

What Happens Next?

- If you have already registered, your TIN (Tax Identification Number) will be displayed.

- If your reference number is valid but not yet registered, you will see a clickable text “e-Daftar”. Click it to proceed.

Step 3: Complete the e-Daftar Application Form

You will be redirected to the e-Daftar application form. Fill in all required personal details, including:

- Full Name (as per IC/Passport)

- Date of Birth

- Address of Residence

- Employment Details (if applicable)

- Any other compulsory fields requested

Step 4: Upload Supporting Documents

As part of the registration, you are required to upload scanned copies of supporting documents:

- Malaysian Citizens: Copy of IC (front & back).

- Foreigners: Copy of Passport (biodata page) and proof of residence in Malaysia (e.g., work permit, student visa, tenancy agreement).

📌 Ensure that your documents are clear and readable before uploading.

Step 5: Submit the Application

- Review all information and uploaded documents carefully.

- Once confirmed, click Hantar.

- After submission, you will receive an application reference number. Keep this for future tracking.

Step 6: Wait for Approval

LHDN will process your application. This may take a few working days. You can check the status of your application by:

- Logging in again to the e-Daftar portal with your reference number, or

- Contact the LHDN customer care line at 03-8911 1000.

Step 7: Activate and Log In to Your MyTax Account

Once approved, you will receive an email or SMS with your TIN and activation details. Follow these steps for your first-time login without a digital certificate:

7.1 Go to the MyTax Portal

Navigate directly to the MyTax Homepage:

👉 https://mytax.hasil.gov.my/ezHasil

7.2 Sign In Using Your ID

- Select your Identification Type (IC/Passport).

- Enter your ID number.

- A pop-up will appear saying no Digital Certificate exists. Proceed by selecting “e-CP55D.”

7.3 Verify Your Information

A confirmation page will display your Identification Number, Full Name, and Email Address.

- Review carefully.

- If correct, click Send.

- A “Success” message will appear, and an activation link will be sent to your email.

7.4 Activate via Email Link

- Open your email inbox and find the activation email from MyTax.

- Click the activation link.

- ⚠️ Note: The link is valid for only 2 days.

✅ You’re Done!

Your MyTax account is now active. From your dashboard, you can:

- Review and update your tax profile

- File tax returns (e-Filing)

- Assign yourself as a Director or Employer Representative

- Manage company roles such as Company Representative (Wakil Majikan)

- Track submissions, notices, and correspondence from LHDN

By completing these steps, you’ve set up your MyTax account and first-time login successfully.